Social Security Disability Insurance (SSDI) is one of the largest of several federal programs of the United States government that provides assistance to people with disabilities. Many people do not know the application process for SSDI. Also people are unaware as to what are the benefits of SSDI and the eligibility requirements for the program. In this article we explain it all in details.

Applying for Social Security Disability Insurance

There are two ways for anyone to apply for SSDI –

- Apply Online at https://secure.ssa.gov/iClaim/dib

- Call toll-free number 1-800-772-1213 (deaf or hard of hearing person may call at TTY number 1-800-325-0778)

Anyone should apply for SSDI benefits as soon as they acquire a disability as the processing too may take three to five months.

Before applying online for a disability benefit under SSDI, you’ll need to create my Social Security account. For creating an account you’ll need to answer a number of questions to verify your identification. So, before you visit the Social Security Website, you should keep the following things with yourself to avoid any hassle –

- Mobile phone (for receiving text and emails for verification)

- Credit Card

- Form W-2

- Tax Forms

Information Required by Social Security Administration

The federal law for granting disability benefits is very strict. So, SSA requires a lot of information before deciding about the eligibility of a person for disability benefits. However, one should not delay in filing an application just because of a lack of required documents. The authorities help a person in gaining any required document that may not be available with the applicant.

Here is a list of information required by SSA before approving the SSDI application.

- Your Social Security Number

- Your Birth Certificate or Baptismal Certificate

- Hospitalization Details including, but are not limited to, names, addresses, and phone numbers of the doctors, caseworkers, hospitals, and clinics that took care of you, and dates of your visits.

- Names and dosages of all the medicine you were prescribed or you take

- Medical records from your doctors, laboratory and test results, therapists, hospitals, clinics, and caseworkers that you already have in your possession.

- Your Work Details viz. a summary of where you worked and the kind of work you did.

- Your most recent Wage and Tax Statement (W-2 Form) or, if you’re self-employed, your federal tax returns for the past year.

How is Disability determined for SSDI benefits?

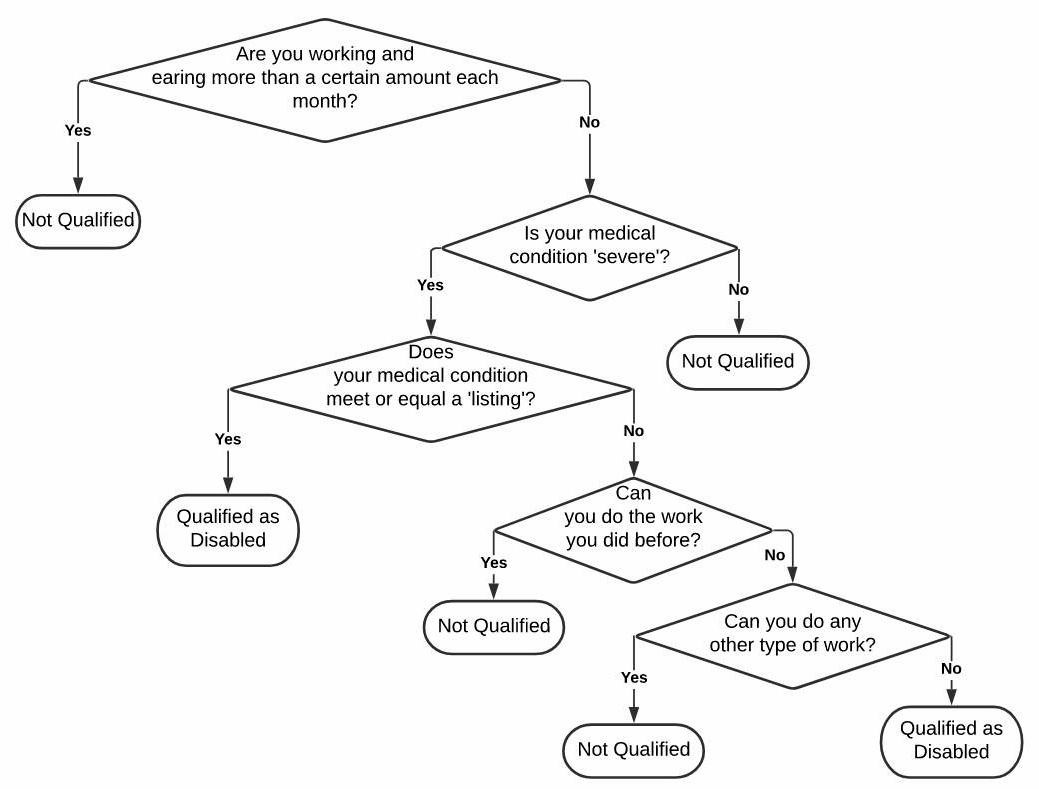

You might be aware that the definition of disability for SSDI is quite different from the ADA definition. SSA uses a 5-steps evaluation process for deciding whether a person may get disability benefits under SSDI.

Step 1: Are you working and earning more than a certain amount?

The first thing that is used to ascertain your disability for SSDI is your earning capacity. If you earn more than a certain amount (this is revised every year) you are not qualified as disabled. If you don’t earn lesser than the prescribed amount or don’t earn at all, authorities will move on to the second step.

Step 2: Is your medical condition severe?

For your disability to be classified as severe for social security, your ability to do basic tasks – sitting, standing, walking, lifting and remembering must be affected significantly for a period of not less than 12 months. If your disability isn’t severe, you’ll be disqualified as disabled for SSDI. If your disability qualifies as severe, the authorities will move to step 3 with your case.

Step 3: Does your medical condition meet or equal a ‘listing’?

The authorities have a listing of impairments that are considered severe enough to prevent a person from being gainfully employed regardless of their age, education or work experience. If your disability meets or if it’s medically equal in severity and duration to an impairment in the listing you are qualified as disabled for the purpose of disability benefit. If your condition does not have any equivalence in the listing the authorities will check the next criteria.

Step 4: Can you do the work you did before?

The agency staff will try to ascertain whether your condition allows you to continue the work you were doing before acquiring a disability. If you can continue your past work despite your condition you are not considered disabled. If the authorities find that your condition will not permit you to do your past work, they’ll move to the last stage of ascertainment.

Step 5: Can you do any other type of work?

Based on your ability level, education, qualification and work experience, the authorities will see if you can be gainfully employed in some other work. If you can be gainfully employed in some other work, you won’t be considered disabled. If you can’t do any other work you will qualify for SSDI benefits.

What happens after the determination of qualifying disability?

Once the decision has been made, you’ll be notified by the authorities. If your application gets approved the notification letter will tell you the amount for which you are eligible and the month from which you’ll start getting your monthly payment. If your application got rejected the letter will provide you the explanation for rejection and it will also tell you the procedure to appeal if you disagree with the decision.

The monthly benefit is calculated on the basis of average lifetime earnings. Typically, monthly payment starts after six months of acquiring a disability. And, the payment is made in the month following the month in which the payment becomes due. It means a payment that becomes due in June will be paid to the beneficiary in July.

Note: There is no waiting period in case the disability results from amyotrophic lateral sclerosis (ALS).

Eligibility of Family Members to get Benefits

Certain family members too may qualify for your disability benefit based on your work. Family members who may qualify includes –

- Spouse if he or she is of age 62 or older.

- Spouse of any age, if he or she is caring for your child who is either younger than 16 years or disabled.

- An unmarried child younger than 18 years of age (or younger than 19 if still in high school), including an adopted child. In some cases, a stepchild or a grandchild too can be eligible.

- An unmarried child older than 18 years of age is disabled before the age of 22. The child’s disability should also meet the criteria of disability for adults.

- A divorced spouse (based on your earning) if he or she was married to you for at least 10 years, is not currently married and is at least 62 years old.

Any person applying for a disability benefit is expected to provide every significant information including an outstanding warrant for arrest, a conviction of a crime, conditions of parole and probation etc. Even when you start getting your monthly payments you are required to update the authorities about any changes in your physical condition or earning capacity.

Use the citation below to add this article to your bibliography

"SSDI: Application, Eligibility, Benefits and Requirements." Wecapable.com. Web. June 18, 2025. <https://wecapable.com/ssdi-application-eligibility-benefits-requirements/>

Wecapable.com, "SSDI: Application, Eligibility, Benefits and Requirements." Accessed June 18, 2025. https://wecapable.com/ssdi-application-eligibility-benefits-requirements/

"SSDI: Application, Eligibility, Benefits and Requirements." (n.d.). Wecapable.com. Retrieved June 18, 2025 from https://wecapable.com/ssdi-application-eligibility-benefits-requirements/

Leave a Reply