Sometime ago we had published an article on disability insurance in India — or the lack of it! Private insurance companies do not easily provide health or life insurance to the persons with disabilities. And if they do, the premium is almost always increased. In such a dismal scenario, the Niramaya Health Insurance Scheme has come as a huge help for the persons with Cerebral Palsy, Autism, Mental Retardation and Multiple Disabilities.

Niramaya Scheme is being offered by The National Trust in collaboration with ICICI Lombard, a private insurance company. The National Trust is a statutory body constituted by enactment of an Act of Parliament by the Government of India, for the Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities.

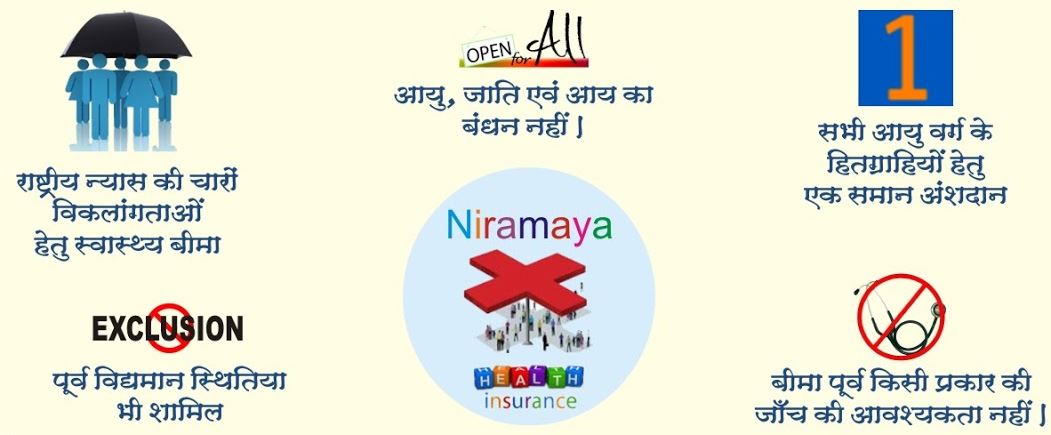

Benefits of Niramaya Health Insurance Scheme

Niramaya Scheme provides the following benefits:

- Same premium irrespective of the age of the person

- Same coverage for all irrespective of the type of disabilities covered under by The National Trust.

- Insurance of Rs. one lakh per beneficiary.

- Insurance is guaranteed. No “selection” will be made. Every persons with developmental disabilities and enrolled with The National Trust will be eligible for insurance.

- Unlike the going trend in the market, no exclusion will be made because of pre-exisiting condition.

- No medical tests will be conducted before providing the insurance cover.

- Services covered under the scheme:

- Regular medical check up

- Hospitalization

- Therapy

- Corrective Surgery

- Transportation

- Repetitive medical intervention as an in-patient

- Pre and post hospitalization expenses

- OPD treatment can be taken from any qualified Medical Practitioner. In-patient (i.e. admitted in hospital) treatment can be taken from any hospital. The cost will be reimbursed (subject to the insurance limit)

NOTE: Niramaya Health Insurance Scheme is available throughout India except in Jammu & Kashmir.

Eligibility Criteria for Niramaya Health Insurance Scheme

- Person should have a disability covered under the National Trust Act

- Person to be insured should have a valid disability certificate.

If a registered organization (e.g. a trust or a society) is interested in insuring persons with disabilities under the Niramaya Health Insurance Scheme, then that organization needs to be registered with the National Trust. Fee for such a registration is Rs. 1000 at present.

Documents Required for Niramaya Health Insurance Scheme

Persons Living Below Poverty Line (BPL)

- Properly filled Enrollment Form

- One passport size photograph of the person to be insured

- Self-attested and valid disability certificate

- BPL Card (both original and photocopies)

- Address Proof (both original and photocopies)

- Proof of payment of applicable fee (bank receipt).

Non BPL

- Properly filled Enrollment Form

- One passport size photograph of the person to be insured

- Self-attested and valid disability certificate

- Address Proof (both original and photocopies)

- Income certificate of (self attested) the parent/guardian competent authority as issued by the State

- Proof of payment of applicable fee (bank receipt).

PwD with Legal Guardian (Other than natural parents)

- Properly filled Enrollment Form

- One passport size photograph of the person to be insured

- Self-attested and valid disability certificate

- Legal Guardian Certificate issued from the Local Level Committee constituted under section 13 of The National Trust Act, 1999

- Address Proof (both original and photocopies)

- Proof of payment of applicable fee (bank receipt).

Fee to be Paid for Niramaya Health Insurance Scheme

Persons living Below Poverty Line (BPL) have to pay a fee of Rs. 250

Non-BPL persons have to pay a fee of Rs. 500

PwD with Legal Guardian do not have to pay any fee.

These fees are to be paid every year.

Renewal of Niramaya Health Insurance Scheme

Enrollment of in the scheme is done until the coming 31 March. For example, if you register on 22 September 2018, you will need to renew the insurance policy on 31 March 2019. The next renewal will be in 31 March 2020.

This way you have to renew your policy on every 31 March.

You will have to pay the renewal fee every time.

We hope this information was useful for you. If you have any more information to share on this scheme, please let me know in the comments section. Also, feel free to ask any questions related to this topic. Thank you for connecting to WeCapable!

Use the citation below to add this article to your bibliography

"Niramaya Health Insurance Scheme for Disabled Persons." Wecapable.com. Web. June 1, 2025. <https://wecapable.com/niramaya-health-insurance-scheme-disabled-persons/>

Wecapable.com, "Niramaya Health Insurance Scheme for Disabled Persons." Accessed June 1, 2025. https://wecapable.com/niramaya-health-insurance-scheme-disabled-persons/

"Niramaya Health Insurance Scheme for Disabled Persons." (n.d.). Wecapable.com. Retrieved June 1, 2025 from https://wecapable.com/niramaya-health-insurance-scheme-disabled-persons/

My daughter aged about 21 is registered under Nirmaya Health Card. In portal the policy period is showing 3-11-2017 to 31.03.2018. How to renew the policy.

Can I get an artificial prosthetic hand using this insurance

1. Child who is permanently disabled their annual premium can be deducted directly from bank automatically every year so that insurance scheme will be not expired.

2. Whether therapy like speech and occupational therapy paid fees can be claimed or not. Please clarify.

Sir,

Myself Benu Chhetri a widow i am writing this for my daughter Christy Chettri she is 80 percentage intellectual disable as per doctor s certificate , i am not well aware of the govt scheme which my daughter can avail , hence it is appreciate if i can get a necessary information and helps to place my daughter for the schemes which rightfully available for her from the govt.

Thanking you in advance

i want to take niramaya insurance policy for my handicap son in mumbai. please email me contact details and address for the same

WHERE THE INSURANCE APPLICATION TO BE SUBMITTED

Kindly send new niramaya policy form as i have submitted documents and it is required.

documents required for registration in niramaya

my son is a 3 and half years old we had the two three therapy and other prosthetic equipments and rgular medicine and OPD.

should we cover the above treatment under Niramaya Health Insurance Scheme

how to apply is any kindly update the link of application

My son is affected with Cerebral Palsy. Now he is at age of 14. My income is more than 10 lakhs. Can my son be registered to avail Niramaya Health Insurance scheme ? If yes, how can I get the Enrolment Form and where should I deposit the same with the required documents ?

SIR, MY DAUGHTER IS DISABLE BY CEREBRAL PALSY. I AM INTERESTED FOR NIRMAYA HEALTH INSURANCE.

KINDLY SEND US LINK TO TAKE ABOVE INSURANCE.

Can I pay premium this policy online or only offline option is there like previous year?

Sir

I am divyang

I want to take nirmaya policy but how take dont know.please inform me

Respected sir ,

My name is Shiva bhushan Rao aged 70 years, I have a daughter aged 34 years old. She is an Epilepsy patient, We have been giving her medication for the last 30 years for Epilepsy and related disorders in a private hospital. Doctors declared that she is an Disabled Person. She is completely dependent. Since I am old, I’m not in a position to maintain the family along with her treatment like MEDICINE, DOCTOR CONSULTATION FEE Etc. I come from a poor class, I request you to help her with regular medical expenditure, consultation fees. We are very much worried about her future. So I request you to help with financial help.